High-end development of special materials under the problem of homogeneity of PE general materials

2025-06-06

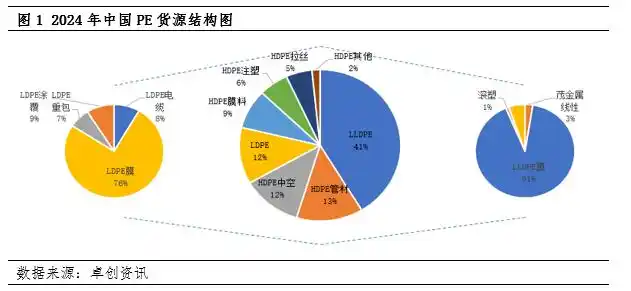

Currently, common PE materials mainly include low-density polyethylene (LDPE), high-density polyethylene (HDPE), and linear low-density polyethylene (LLDPE). These are characterized by large-scale production and low cost, but their performance is relatively basic. Due to the concentrated release of new industry capacity, the supply of various types of general-purpose materials has gradually increased. The following figure shows the supply share of PE by type in China in 2024. LLDPE and HDPE, as the main PE supply products, account for approximately 88% throughout the year, while packaging films and agricultural films, as the main downstream consumer areas of PE, have a domestic base material supply that reaches nearly 50% of the year. The homogenization of general-purpose materials will inevitably lead to a decline in market prices. Petrochemical enterprises seize market opportunities and the needs of new fields, giving rise to high-end PE products such as metallocene PE, bottle cap-specific materials, LDPE high-voltage cable materials, CPE, and UHMWPE. Some high-end PE products adopt a one-to-one customized, direct-from-manufacturer sales approach.

Domestic Supply of High-End Polyethylene Products

As one of the world's largest-produced plastics, PE is widely used in packaging, construction, and agriculture due to its excellent chemical stability, processing flexibility, and cost advantages. However, with industrial upgrading and market demand diversification, polyethylene materials are gradually transitioning from general-purpose to specialized types to meet the stringent performance requirements of high-end application scenarios. Below is a summary of the supply of some domestic PE special materials:

LDPE Cable Material: Only eight petrochemical enterprises have the capacity to produce LDPE cable materials, with a total capacity of 2 million tons. From the perspective of plant production processes, all use high-pressure tubular methods. Geographically, most production enterprises are concentrated in North China and East China. Currently, there is still a problem of petrochemical enterprises being far from modification factories. For example, Northwest production enterprises need to transfer most of the cable base materials to the East China region for sales. Currently, the main domestic LDPE cable-producing petrochemical enterprises are Shanghai Petrochemical, Lanzhou Petrochemical, and Yangzi BASF, involving specifications such as Shanghai Petrochemical's DJ200A, DJ210, Lanzhou Petrochemical's 2240H, Yangzi BASF's 2220H, and Zhejiang Petrochemical's 2220H, etc. Lanzhou Petrochemical's research and development of CL2140P has also broken the monopoly of foreign products. Lanzhou Petrochemical's 2240H, Yangzi BASF's 2220H, and Zhejiang Petrochemical's 2220H, etc. Lanzhou Petrochemical's research and development of CL2140P has also broken the monopoly of foreign products.

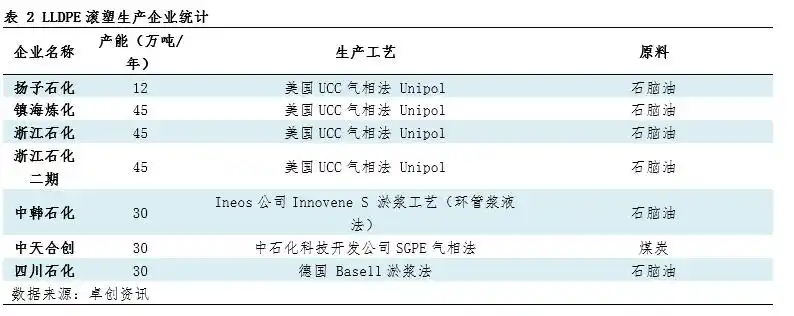

LLDPE Rotational Molding: There are a total of six rotational molding production enterprises in China, involving four processes. Yangzi Petrochemical, Zhenhai Refining & Chemical, and Zhejiang Petrochemical all use the American UCC gas-phase Unipol process, with a total annual production capacity of 1.47 million tons, accounting for 62.03% of the total rotational molding capacity. Representative grades include Zhenhai Refining & Chemical's R546U and 4527C, accounting for approximately 60% of the annual total, Zhejiang Petrochemical's 7149U accounting for approximately 20%, and Yangzi Petrochemical's 7527C accounting for approximately 8%. Other petrochemical enterprises have lower production frequencies.

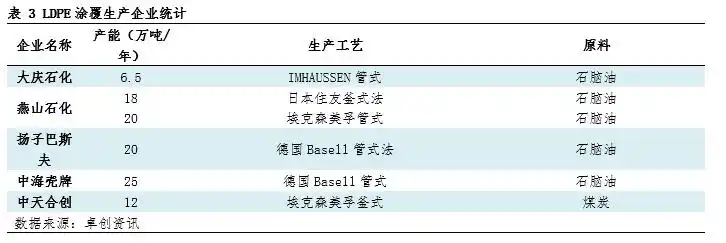

LDPE Coating: There are five LDPE coating production enterprises in China, with a total capacity of 1.015 million tons. Tubular methods are mostly used in the production process. Yanshan Petrochemical's old LDPE lines 1, 2, and 3 all use the Sumitomo kettle method from Japan. In 2024, China's LDPE coating material production was 282,400 tons. Yanshan Petrochemical, Zhongtian Hechuang, and Daqing Petrochemical were the main exporting enterprises, accounting for approximately 50%, 34%, and 10%, respectively. Yangzi BASF and CNOOC Shell had lower production frequencies. Representative grades include Yanshan Petrochemical's 1C7A, Zhongtian Hechuang's LD251, and Daqing Petrochemical's 19G. After Yanshan Petrochemical's later maintenance, the supply of domestic coating materials decreased significantly.

Other Specialized Materials: HDPE bottle cap-specific materials have strict requirements for material odor, moldability, and torsional properties. Currently, the main domestic petrochemical enterprises producing bottle cap-specific materials are Fushun Petrochemical, Panjin Ethylene, and Borealis. Annual output is approximately 150,000 tons. Fushun Petrochemical's FHP5050 accounts for approximately 80%, while Panjin Ethylene's 5070 and Borealis's 5331H each account for approximately 10%, all concentrated in the Northeast region. IBC tanks (intermediate bulk containers) are mainly used for liquid storage and transportation in the chemical, food, and pharmaceutical industries, and have extremely high requirements for specialized materials. Their proportion in domestic PE production is relatively low, and annual output is not stable. CNOOC Shell's 4261A, and CNPC-SK's B5706J and B590 have a relatively high production proportion. By adding antioxidants and UV stabilizers, they meet the needs of long-term outdoor use. In 2025, the production proportion of HM4560UA from CNPC Tianjin also slightly increased. Ultra-high molecular weight polyethylene has stable and steadily increasing production compared to bottle cap materials and IBC tanks. As of 2024, the total production capacity reached 401,400 tons, mainly in North China and East China. In the future, the global UHMWPE industry will continue to maintain rapid development, and lithium battery separators, medical materials, and fiber materials are expected to remain key drivers of global UHMWPE production growth.

Technological advancement, refined application, and green production may become future trends.

In summary, during the period of polyethylene capacity expansion, the homogenization of general-purpose material products has become increasingly severe. Taking the linear melt index 2 specification 7042 as an example, the market price center continues to shift downward, constantly approaching the cost line, and is difficult to improve. This is mainly due to the increased production proportion of plants put into operation in recent years, such as Inner Mongolia Baofeng, etc., increasing supply-side pressure, but demand-side stimulation is limited. Under the contradiction between supply and demand, market prices are difficult to support.

At present, the production proportion of high-end special materials has increased. For example, Lanzhou Petrochemical's LDPE plant, Daqing Petrochemical's HDPE plant, and the new full-density plant of Dushanzi Petrochemical are all improving the research and development and production of the high-end special materials mentioned above. At the same time, the POP catalyst technology developed by the Lanzhou Petrochemical Research Center of China Petroleum has successfully solved the problem of ash content introduced by traditional inorganic carrier catalysts, enabling the screening rate of UHMWPE fiber-specific material U50F to reach 99%, with performance comparable to international standards. The specialized materials market will show three major trends: "technological advancement, refined application, and green production." Future development areas such as the new energy field, aerospace, special protection (such as bulletproof materials), and marine engineering (corrosion-resistant ropes) all have a certain market share waiting to be developed.

Contact us

Email:

xucipeng163@163.com

Mobile:

+86-139-2217-2108

Company address:

Haoliang Industrial Park, Longtang Town, Qingcheng District, Qingyuan City, Guangdong Province

Service hotline:

Service mailbox:

5-year warranty commitment, lifetime technical consultation - Lianhong Pipe Industry, making pipes the most reliable silent partners

HUATAO GROUP

Online message to get application solutions for free

Copyright © 2025 Guangdong Lianhong Pipe Industry Co., Ltd.